The spirits sector supports around 1.2 million jobs in the EU, the UK, Norway and Switzerland (=EU+), according to a new economic footprint study launched last week. This is about 0.5 % of the overall EU+ employment and almost approaches the size of the entire work force of Lithuania.

Commissioned by spiritsEUROPE and prepared by the Institute of Advanced Studies in Vienna (Austria), the report examines the considerable positive economic impact springing from the production and consumption of spirits across Europe, analysing the direct employment created and value added in distilleries, the sector’s sizeable tax contributions as well as its beneficial indirect spill-over effects on agriculture, hospitality and tourism (click here for a summary of key findings).

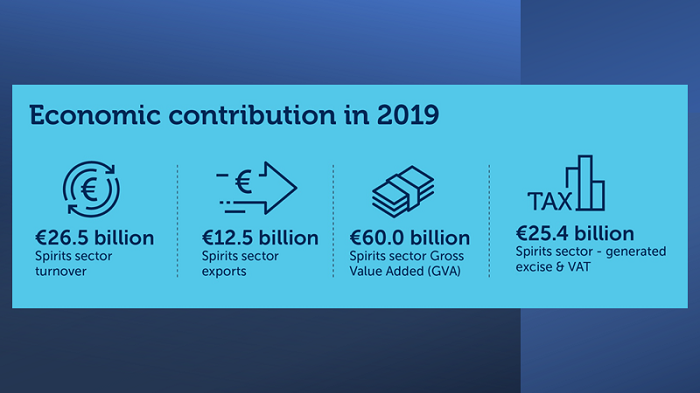

The sector’s overall production turnover was estimated to amount to EUR 26.5 billion in 2019, a considerable increase from 2015 (+13 %). Five countries represent more than three quarters of the entire production: the United Kingdom is the largest producer, followed by France, Germany, Italy, and Poland. Ireland now takes the sixth rank. Whisky is the biggest spirit drink category in Europe in both value and volume, followed by brandy, vodka, flavoured & national spirits, gin and rum.

The report estimates that spirits-related contributions in taxes and duties amounted to about EUR 46.8 billion in 2019 which is more than a quarter of the annual EU budget. Around half of this amount was generated from VAT and excise duty imposed on spirits beverages sold in the EU+. The other half came from income, profit and other taxes on general economic activity along the value chain. Furthermore, the report presents an in-depth analysis of the sector’s considerable downstream value for hospitality and tourism.

The overall Gross Value Added (GVA) from the production and consumption of spirits in the EU+ was estimated at EUR 60 billion in 2019. This was about 0.4 % of the total GVA in the EU+ and would be more than twice the overall GVA of Latvia.

The report demonstrates the significant and manifold contributions the spirits sector makes to Europe’s economy, particularly in the many rural areas where most of spirits’ production is located. Unfortunately, the COVID-19 crisis has had a massive negative impact on the numbers presented in this report, given the far-reaching restrictions in the hospitality sector, the dramatic drops in spirits tourism and declining sales, for instance, in the travel retail segment in airports. What Europe’s distillers and the value chain partners in hospitality and tourism now need is structural support and a favourable policy environment to become once again engines for jobs and growth during the recovery.