The latest consultation on DG TAXUD’s review of the excise tax structures directive was launched in May and the spirits sector has been closely engaged. We have again sought to emphasise that, while a review of the directive can certainly bring improvements, notably in relation to denatured alcohol, there appears to be little else that would address the spirits sector’s longstanding difficulties.

The latest consultation on DG TAXUD’s review of the excise tax structures directive was launched in May and the spirits sector has been closely engaged. We have again sought to emphasise that, while a review of the directive can certainly bring improvements, notably in relation to denatured alcohol, there appears to be little else that would address the spirits sector’s longstanding difficulties.

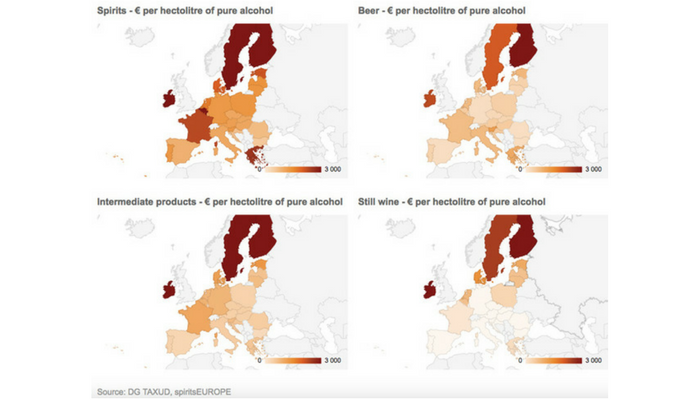

A fundamental aspect is that the current review seeks to address problems which are caused by a separate directive (Directive 92/84 not being reviewed), which sets out the minimum excise tax rates on alcoholic beverages. The basic unfairness of the latter’s rules is evident: ethanol is found in every alcoholic beverage but the ethanol in wine does not need to be taxed; the ethanol in beer must be taxed at no less than €1.87 per litre, while for spirits it is €5.50 or, in most cases (24 of the EU’s 28 Member States), at least €10 per litre (of pure alcohol). All alcoholic beverages compete with one another; but the current rules mean they do not do so in a level playing field. It remains difficult to see how the complications that derive from the minimum rates directive rules can be resolved by reviewing establishing tax structures.

Whatever conclusions emerge from the consultation, we will of course continue to discuss the issue with legislators and will seek to ensure that the current unfavourable treatment of the spirits sector is not made worse.