In 2013, excise tax was increased by 40% in Romania. This resulted in a 32% decline of the legal taxed market and a revenue loss for the state budget. The increase not only damaged the legitimate sector without generating additional revenues for the State, but there were also regular reports of alcohol poisoning due to the consumption of surrogate/denatured alcohol. As a consequence of all the problems, the Romanian Government decided to lower the excise rate on spirits by 30% from 1 January 2016.

Unfortunately, a year after the decrease, excise revenue is not yet back to its level before the tax increase. We fear that, in pushing taxes so high, the government has forced consumers towards the black market. (Romania is unfortunately not the only EU country whose excessive taxes drive consumption underground.). National studies and the OECD have found that, once consumers use black market supplies it is very difficult to persuade them to return to legitimate sales channels.

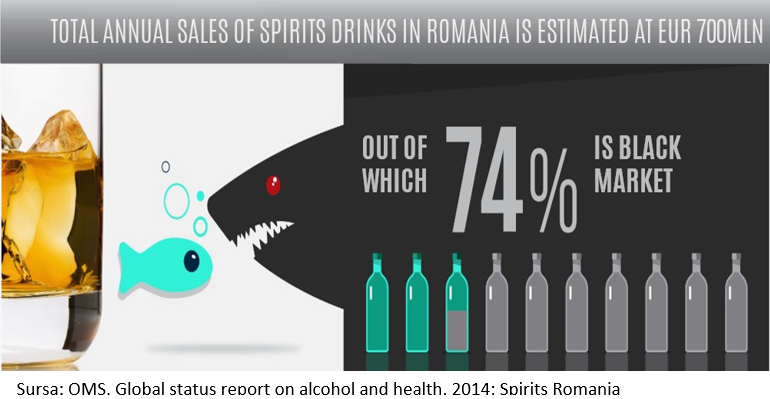

It will take time, therefore, for revenues to recover but there are some positive signs on the market with the volume of legal sales increasing. The priority of the industry, together with the Government, is to fight the black market in Romania. Today, the total market value is €700m of which only €180m is taxed consumption: apart from the criminals, everyone is losing out. If all the consumption was taxed, the Government would generate another €200m a year at least… Producers could invest in new production plants, thereby creating new jobs and growth. Consumers would not be tempted to buy from the illicit market, putting their lives in danger by drinking counterfeit alcohol whose quality is not controlled or tested.

It is disappointing that Lithuania, despite warnings, decided to keep increasing excise duty on alcohol; another 23% was added on spirits on 1 March 2017. The results were unfortunately immediate! The President of the NGO “Lithuania without a shadow” is reporting the deaths of two men from alcohol poisoning in a month and 52 new reports of locations selling illicit alcohol (3 times more than in a normal month – visible on a public website launched by the association in 2013).

We understand that the overall goal set by the Commission to Member States is to decrease taxation on labour and increase it on consumption but on spirits this is a self-defeating and dangerous route.