All alcoholic beverages contain an identical compound - ethanol. The drinks are found alongside one another in bars and cafes and on supermarket shelves. In the current warm weather, when outside on a terrace, one might opt for a glass of sparkling wine, a gin and tonic or perhaps a bottle of beer. Despite the blindingly clear reality, we are told that there is no competition between these drinks and therefore they do not need similar taxation. This fiction is convenient because it means nothing is done to address the serious market distortions created by the EU’s excise tax directives.

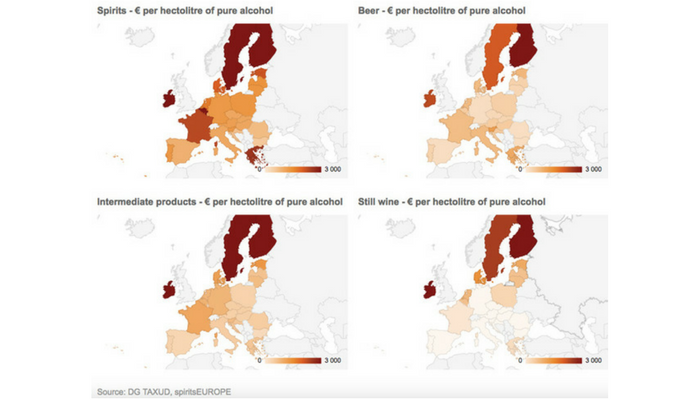

The rules were laid down in 1992 and have not changed since. They require the ethanol in your beer or wine to be taxed at a much lower rate than the ethanol in your rum and coke, even though all the drinks share similar properties. The discriminatory impact means that spirits have only a 25 % share of the EU alcoholic beverage market but pay 45% of the tax revenues. Beer, the biggest sector, has 42% of the market yet accounts for just 32% of tax revenues.

The proposal recently published to amend some aspects of EU rules plan to give the beer sector (and cider) even more tax advantages than they already enjoy. The current reduced tax rates available for “small” breweries are 1,000 times more generous than the related reduced rates for small distillers; the latter’s reduced rates are essentially meaningless. And now we face a situation where large brewers will also be given tax breaks, through an increase in the threshold, from 2.8% to 3.5%, at which all beer can be subject to lower tax rates. There are no similar provisions for spirits.

In sum, the proposal is manifestly and unnecessarily unfair and will introduce further discrimination in favour of the sectors of the market which already enjoy massive preferences compared to spirits. While there are other elements in the proposal (for non-potable alcohol) which seem positive, the tax provisions go completely in the wrong direction.