In an effort to facilitate the functioning of the internal market, the European Union created a common legal framework for VAT and excise tax. The excise legislation defines the alcohol products that are subject to excise duty/VAT and, among other things, sets down the minimum rates of tax that must be applied for each category, as follows:

€1000/hlpa for spirits €187/hlpa for beer €0 / hlpa for wine

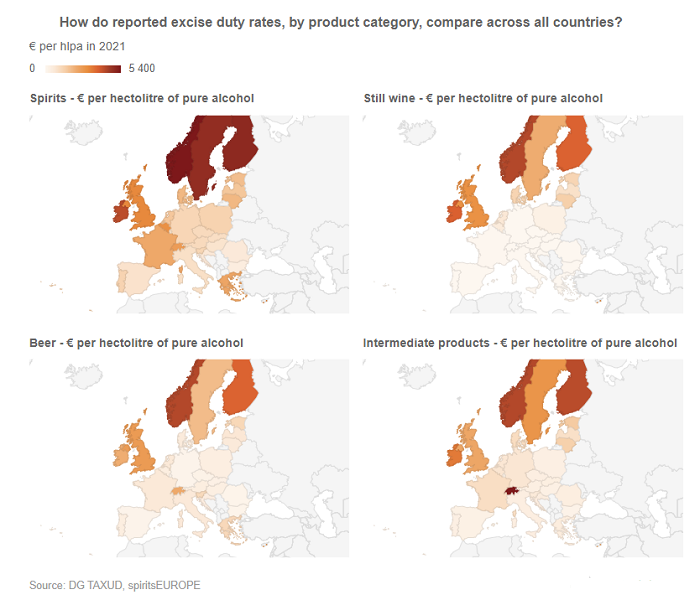

These are the minimum rates and Member States have the freedom to set rates at much higher level.

1) To date, 16 countries (EU+) have no excise duties on wine (see rates across EU + including Norway, UK & Switzerland) compared with 14 countries with duties. Since all alcohol beverages compete with each other, the excise tax system should not distort that competition.

2) The Revenues from excise and VAT taxation go to national governments: €25.4 billions collected in excise duties and VAT for exchequers in EU+ in 2019.

3) Excise tax is a heavy burden on consumers. On average, 2/3 of the price paid by European consumers for a bottle of spirit is tax.

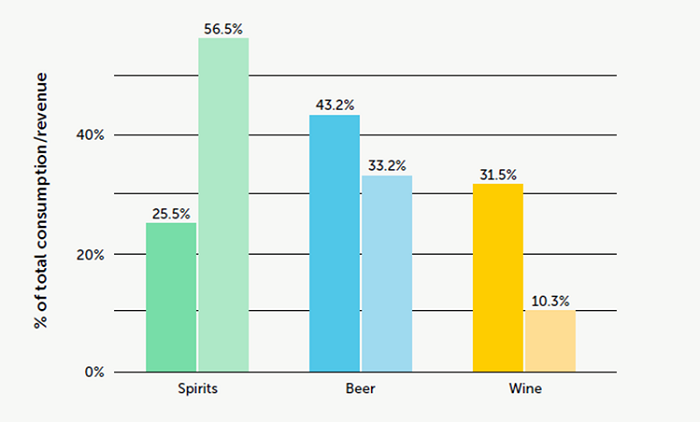

4) Lower consumption but higher tax

The spirits sector is contributing the most despite being the least consumed product category.

Excise Tax Table - January 2021