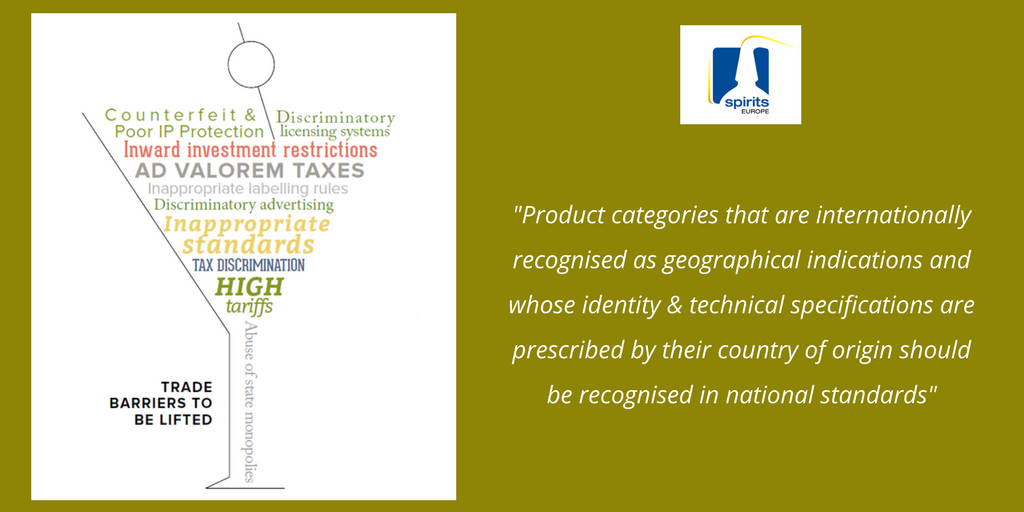

High import tariffs

While most duties on spirit drinks among developed nations are liberalised or relatively low, some countries continue to apply very high duties on imported spirit drinks. Tariffs imposed on imported spirits can be either levied on a “specific” (X amount per unit of alcohol) or “ad valorem” (% of the price) basis. The latter has a greater impact on imports of EU quality spirits.

India (150% tariff), Thailand (60% tariffs); Brazil (20% tariff) or China (10% tariffs) are good examples. In these countries, the market shares of EU imported spirit drinks is less than 5%.

Discriminatory taxation

Tax policy in some markets discriminates against European spirits by significantly raising their retail prices relative to domestically-produced spirits. When taxes are set at excessive levels, consumers tend to shift demand to no tax or low tax categories of alcohol beverages or to illicit alcohol, synonymous with additional enforcement costs and health risks.

European spirits frequently confront national excise tax systems that favour domestically-produced spirits in contravention of GATT Article III (General Agreement on Tariffs and Trade). The WTO dispute settlement body has reviewed four excise tax systems for spirits (Japan, Korea, Chile and the Philippines) and found that each of the excise regimes applied a lower tax to domestically produced spirits than to imported spirits, thereby affording protection to the domestic industry contrary to GATT rules.

Counterfeit & poor IP protection

European companies have made significant investments in building brands and categories, creating strong international reputations based on unique qualities and characteristics. Unfortunately, because of their success, many European spirits are the object of imitations and knock-offs that attempt to capitalise on the reputations built over time, and that compete unfairly with legitimate products.

The exact scale of the problem is difficult to evaluate, given its clandestine, criminal nature, but in some markets we estimate that illegal alcohol can account for up to 30% of sales. The consequences:

More reading on international studies related to illicit and counterfeit trade:

Complex customs procedures

When exporting to third countries, spirits exporters often face complex and lengthy customs procedures, excessive certification and documentation requirements, high levels of fees and charges and poor regulatory transparency. Non transparent and complex customs procedures increase the transaction costs for doing business internationally. In some markets, valuation procedures are not followed according to the WTO Customs Valuation Agreement, leading to the imposition of undue additional duties and taxes.

Discriminatory and inappropriate technical legislation

Divergence of standards can, in some cases, be a bigger impediment to market access than tariffs. Typical concerns regard product definitions and technical requirements. While countries are free to determine their internal regulations, in some instances, rules prevent or limit the import of products which may be sold perfectly legally in the European Union and elsewhere.

Excessive labelling schemes are often an impediment to trade, most notably for SMEs. Concerns related to labelling include questionable lists of information to be provided, and overly prescriptive requirements on the placement and size of the label.