The EU & the US are each other’s first spirits export market and most EU spirits companies have production facilities in the US – particularly of American Whiskey – while most US spirits companies own distilleries in the EU – be it Cognac, gin or Irish Whiskey.

In their landmark agreement, the U.S. and the EU eliminated tariffs on most spirits categories in 1997. This “zero-for-zero” agreement has boosted transatlantic spirits trade, resulting in a +450% growth in bilateral trade in spirits and reaching €6.7 billion in 2018, before the introduction of retaliatory tariffs. The zero-for-zero agreement has strengthened cross-investment and supported thousands of jobs in both markets. Its absence now risks setting back these gains and undermining confidence in the transatlantic partnership.

We urge both sides to remain at the negotiating table and deliver a swift, full return to zero-for-zero. This means reaffirming the support for our sector across the Atlantic by removing US tariffs on EU spirits and lifting any suspended EU retaliatory measures on US products. Restoring this agreement and predictability in transatlantic spirits trade is essential for enabling our sector to thrive through fair and reciprocal trade that benefits farmers, distillers, retailers, hospitality workers and consumers alike.

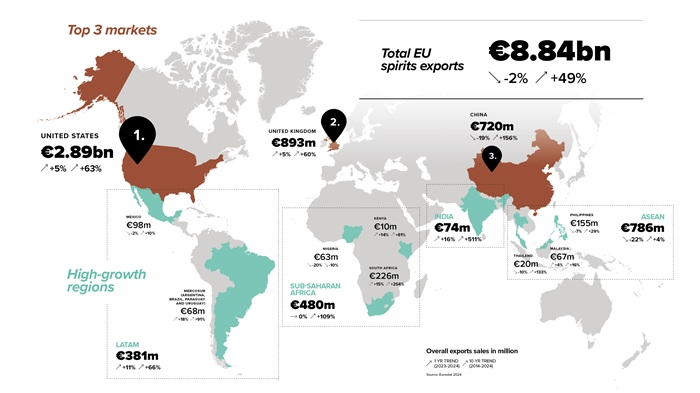

China is both the first spirits market and the first spirits producing country in the World. Mainland China is also EU spirits’ 3rd biggest export market in value, with a historical preference for EU wine-based and marc-based spirits, and further potential for growth. In 2023, before the launch of an anti-dumping investigation into EU brandies, the overall value of EU spirits exports to China (direct, indirect and duty-free) exceeded €1.5 billion.

Producers of EU geographical indications such as Cognac have been present on the Chinese market since the mid-19th century, demonstrating a long-term commitment to the Chinese market. They keep supporting both EU rural communities and countless Chinese downstream sectors in the process, from distribution to the hospitality sector. European spirits producers are also increasingly investing in the production of international spirits categories in China.

However, EU spirits’ success story in China is at risk due to growing geopolitical and trade tensions, with spirits increasingly caught in unrelated trade disputes. Given the size and strategic importance of the Chinese spirits market, European spirits producers are committed to long-term investments in China, provided frictionless trade in spirits can be preserved, and spirits can be kept out of unrelated disputes.

EU-China Working Group on Alcoholic Beverages:

Following the decision reached at the 2023 EU-China High-Level Trade & Economic Dialogue to relaunch the EU-China Alcoholic Beverages Working Group, the Working Group met on 26 April 2024, under the joint leadership of the General Customs Administration of China (GACC) & DG AGRI. The Working Group provides a fantastic platform to discuss regulatory cooperation and standards, sustainability objectives and efforts in the wine and spirits sectors, IPR protection and Geographical Indications promotion. This first meeting after many years highlighted the need for reinforced and closer cooperation between the EU & China on alcoholic beverages, marking an important milestone towards reinforced cooperation with China on wines and spirits.

The UK is the EU’s second largest spirits export market and also a major source of EU spirits imports, with much cross-investment in the sector across the Channel. It is time to reset the EU-UK relationship. Cooperation with the UK should be reinforced to address global challenges and common issues affecting EU & UK spirits producers.

With a population of over 1.4 billion inhabitants and a growing middle class, India –the second biggest spirits market in the world in volume – is one of the most promising markets for EU spirits. Still, the value of EU spirits exports to India in 2024 was a mere €74 million (compared to €719,7m to China). An import duty of 150% ad valorem (100% Cess + 50% customs duty) applies to imported alcoholic beverages in India – one of the highest rates in the world. Securing a substantial tariff reduction for EU spirits must be a priority for EU-India negotiations. It will be critical to avoid compensation through tax increases at state level.

The ASEAN region is already a key area of focus for European spirits exports. 3 ASEAN countries – Singapore, the Philippines and Malaysia – already feature in our top 20 export markets, with total direct exports reaching €783 million in 2024. The ASEAN region will grow further in importance over the coming years, as it is set to become the world’s 4th largest economy and 3rd most populous region by 2030. The EU should adopt an ambitious trade policy towards ASEAN countries, for both economic and geopolitical reasons. This could unlock the largely untapped potential for EU spirits exporters in the region who continue to struggle with a mixture of high tariffs and challenging local tax and regulatory environments. It would also help to close the gap vis-a-vis spirits producers from those parts of the world (e.g. UK, Australia, China, Japan) that already benefit from sizeable tariff reductions thanks to existing bi lateral and regional agreements (such as CPTPP & RCEP).

Canada is an important, built challenging market for EU spirits. CETA provisionally entered into force on 21 September 2017. The joint progress report, adopted at the end of 2022, highlighted the remaining issues of concern. These issues are discussed on an annual basis as part of the CETA wine & spirits Committee.

Over the past years, European spirits producers have increased their trade and investment footprint in Africa, with significant potential for further sustainable growth still untapped. Imported spirits only represent a minority of overall spirits consumption in most of the region – for example, 10.3% and 4.7% of overall spirits consumption in Kenya and Nigeria respectively. The AfCFTA - Agreement Establishing the African Continental Free Trade Area - will provide opportunities to increase intra-African trade and to create conditions for more sustainable investment in supply chains and jobs.

To develop a closer partnership with the continent, the right trade and investment conditions need to be in place. To this end, we urge the EU to focus on:

In its New Agenda for Relations between the EU and Latin America and the Caribbeans, the EU confirmed the place of this region as a strategic partner – including for trade. With a population of about 652 million inhabitants, a combined GDP of US$ 6 trillion, and 16 of the world’s top 100 touristic destinations, Latin America and the Caribbean represent promising markets in the frame of EU spirits’ export diversification strategy. In 2024, the value of EU spirits’ combined exports to CELAC reached €381 million – but we could do much better, with the right conditions.

The EU-Mercosur trade agreement is a landmark development for European spirits producers, and will offer expanded market access, tariff elimination, and stronger protection for geographical indications (GIs) in South America, once in force.

To find out more about the benefits of the EU-Mercosur FTA for European spirits producers:

Whilst fully respecting religious and cultural sensitivities and strict controls on alcohol consumption in the region, there is growing demand and opportunities for spirits in the Middle East. Spirits represent a significant proportion of alcoholic beverages consumption in volume (around 22% in 2023) in the Gulf region, and EU spirits direct exports to the region were worth around €221 million in 2024. There are several areas the EU can address in bilateral negotiations with GCC individual members to facilitate business and export opportunities for EU spirits producers while also respecting religious sensitivities. These include ensuring reasonable access to alcoholic beverages for the tourism and hospitality sectors, and the expat community.